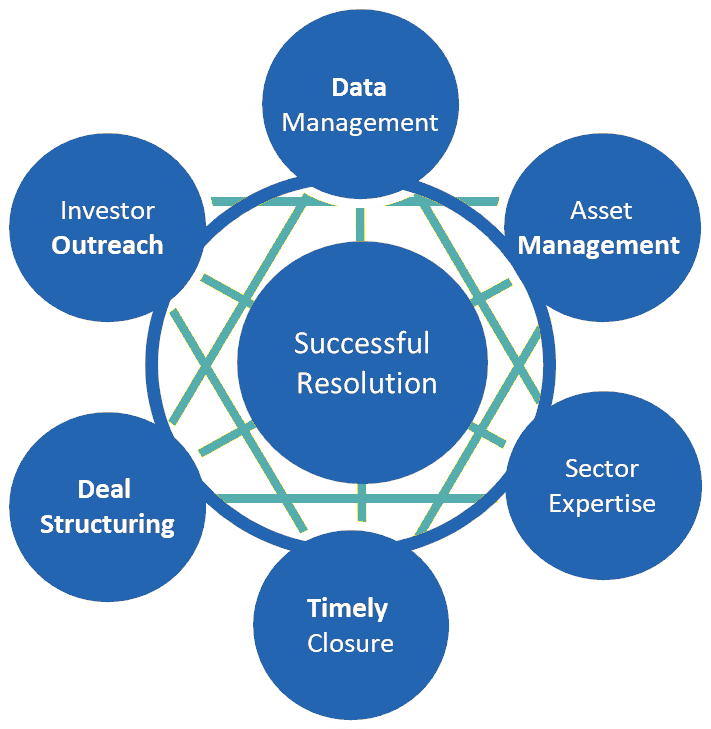

Support Services to Insolvency Professionals, who are Partners of Decode Resolvency International Private Limited

Decode provides support services to its partners who are also Insolvency Professionals and are empanelled with leading banks and financial institutions. As an Insolvency Professional Entity (IPE) we assist them in carrying out various assignments where they may be appointed, including their appointment as:

- Interim Resolution Professional (IRP) in the Corporate Insolvency Resolution Process (CIRP) of any Corporate Debtor (CD)

- Resolution Professional in the CIRP of any Corporate Debtor

- Liquidator in the Liquidation Process of any Corporate Debtor (CD)

- Liquidator in the process of Voluntary Liquidation of a Corporate Debtor under section 59 of the Insolvency and Bankruptcy Code, 2016 (IBC)

- Resolution Professional in Fresh Start Process under Chapter II of the IBC, 2016

- Resolution Professional in Insolvency Resolution Process of Individuals, Proprietorship

- Concerns and Partnership Firms under Chapter III of the IBC, 2016

- Bankruptcy Trustee in the Bankruptcy process of any Individual or Partnership Firm